Key Points

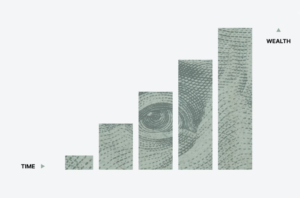

- The balance sheet is a statement giving insight into the financial health of a company by allowing investors to calculate various ratios based on assets, liabilities and shareholder’s equity.

- Fundamental analysts with a long-term investment strategy will look at the balance sheet to further understand the financial strength of a company as it shows what the company owns and owes at the same time.

- The balance sheet, similar to the income statement, is an extensive flow of information over time where you can see how change is occurring in the company through the numbers.

- When it comes to financial analysis, the numbers do not lie and the balance sheet has numbers riddled all over but there are a few financial ratios every investor can utilize to help with investment decisions.

Debt is Okay but too Much and No way to Pay it Off is Not Great

Three Ratios to Understand on the Balance Sheet

Debt Ratio

The debt ratio is one of the more simple but yet effective tools investors utilize when looking into the financial health of a company. This ratio is calculated using the below formula where the company’s total debt is divided by their total assets.

It shows investors what percentage of their debt is financed by their assets and gives insight into the leverage of the company.

If a company has a debt ratio greater than 1 with poor Free Cash Flow(FCF) and a weak Business Outlook, it could indicate the company might potentially struggle to meet their debt obligations.

An important aspect to take into consideration when using this financial ratio is how capital intensive one industry might be compared to another. For example, an energy company will most likely have higher debt ratios than a technology company.

Debt Ratio= Total Debt/ Total Assets

Cash Is King and Companies with Lots of it Can do A LOT

Current Ratio

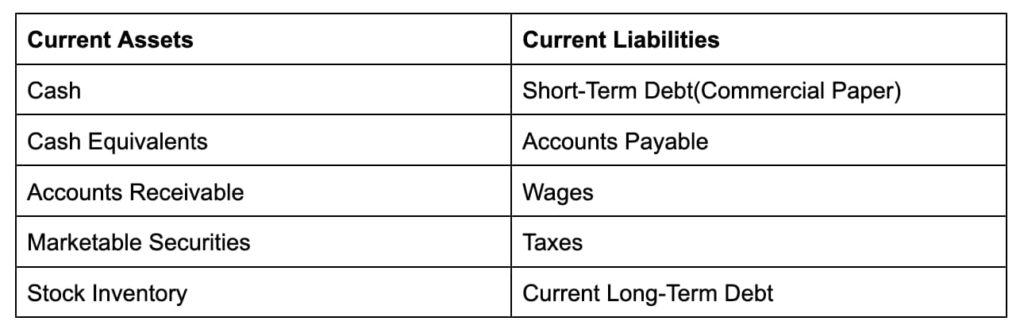

Also known as working capital, think of the current ratio as a way for investors to see if a company can pay their short-term obligations with their current assets. This is readily available on the balance sheet and is captured by taking current assets divided by current liabilities.

A company with a current ratio less than 1 indicates they might not have the financial resources to remain solvent with their short-term obligations.

Current assets are defined as those which can be easily converted into cash within a year or less. If a company holds ownership in something that is highly liquid it can possibly be deemed a current asset.

Current liabilities are those which are necessary to pay to allow for a company to keep operating in the short-term which is usually one year.

While it is comforting to see a current ratio of 1 or greater, investors should not become overly alarmed if a company has a ratio of less than one. There can always be more to the story as the ratio is subject to change and a company might still have the ability to comfortably meet debt obligations.

Current Ratio= Current Assets/ Current Liabilities

Cash Ratio

The cash ratio is similar to the current ratio as it allows for investors to gain insight into a company’s liquidity and whether or not they will be able to meet their short-term obligations.

It differs from the current ratio in that this metric captures cash, cash equivalents and easily marketable securities. Investors will use this ratio to obtain a strong understanding if under a worst case scenario which current assets could quickly be deployed to pay off debts owed.

The formula for this financial ratio is calculated by taking cash,cash equivalents, & short-term investments divided by current liabilities. These numbers can be found on the balance sheet.

Cash Ratio= Cash & Cash Equivalents/Current Liabilities

Companies are Like People. Some are Financially Sound Others Are Not

Just like your everyday individual is advised to build an emergency fund large enough to cover any shortfalls in life, companies will handle their finances in a similar manner and investors are able to view this by looking into the balance sheet.

Having stockpiles of cash not only gives comfort in knowing a company can meet debt obligations, it also lets investors know they have the ability to reward shareholders in various ways.

This can include share buybacks, dividend increases, or reinvesting the cash into projects to help grow the company.

If cash begins to decrease it is not always a negative sign because it could mean the company is starting to put it to appropriate use. Think about when someone purchases a home (asset) which ultimately can result in an increase in net worth over time.

Many of the best performing companies in the equity market show attractive financial ratios on their balance sheet. As a matter of fact some organizations even run into issues where they have too much cash and are not sure what to do with all of it.

For some companies, their balance sheet strength might not be as robust as another and it might draw concern over liquidity issues. While this should always warrant further investigation, it does not mean a company could still not be worthy of investing because their Business Outlook might remain very attractive because of their TAM (Total Addressable Market).

This can be true for companies who are just starting out with lots of room to grow and need to build their balance sheet strength in due time.

Another important factor to take into consideration is that the balance sheet can hold different key features in relation to the design of a particular industry.

An example of this would be the financial services industry but investors are not necessarily accountants; they just have a bit of an understanding of how to read a balance sheet and income statement in helping them make their investment decisions. It is one of many considerations that go into a well-rounded investment thesis.