Key Points

- Often when the word “model” is thrown around to new investors, they begin to shudder but the Dividend Discount Model is relatively easy to grasp.

- In the most simplistic form, the model takes the sum of all future dividends and discounts it back to present value using the risk free rate.

- The output of this model is a share price that is called “intrinsic value”- compare this to the market value and you have an idea of whether shares are under or over priced.

- At Genvest we think it is good to have an understanding of this model but view valuing a company as more of an art than a science. Qualitative analysis combined with Quantitative analysis can be a winning formula.

- A dividend is a cash payment made to equity shareholders from company earnings. It is their way of rewarding you for being a loyal investor in the company. A quality company will work to grow this annually.

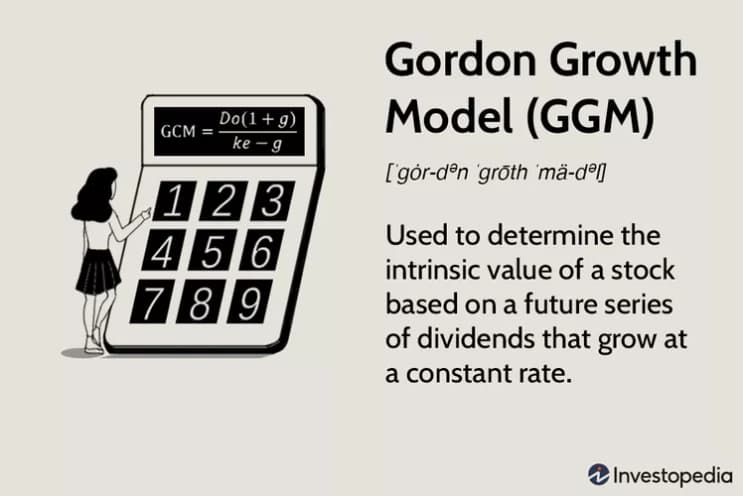

- The Gordon Growth Model is the most popular Dividend Discount Model utilized.

Helps Investors See if a Company is Trading at Discount By Looking at Expected Future Dividend Payments

The Dividend Discount Model (DDM) has several variations but at its core looks to provide investors with the intrinsic value of a company to compare against the market value.

This is accomplished by taking the expected sum of all future dividend payments and discounting it back to the present value.

If the price is above the current market value, this could be a sign for you to invest since the market is undervaluing the company. You could compare this to when a retail store has items selling at a discount.

Think of it like a sale but instead it is the common stock of a company and it could even increase in value over the long-term.

However, sometimes the market value will be above the intrinsic value and this is because investors are highly optimistic about the future of the company which is driven by investor sentiment.

You do not want to overpay for the stock of the company but it could be a sign investors think from a relative valuation standpoint XYZ company is truly superior compared to their competitors.

To see a more in depth breakdown of this with an example..Check out this article from Investopedia using the Gordon Growth Model, it is one of the more popular Dividend Discount Models used to evaluate a company growing their dividend.

GenVest QuickTake

Take some time to learn about the future business prospects of the company. If there is ever a dip(correction) in the market, it could be an opportunity to scoop up some shares to hold over the long-term.

A company that should be able to keep growing their dividend on an annual basis is always worth considering for the portfolio but it only tells one part of the company’s unique story, find out the rest of it.