Key Points

- Company leadership is a key criteria for investment that we believe is underrated in the modern investing landscape. Quant models and projections rarely take this into account.

- CEO’s and their team are vital to the success of the company today and into the future- they set the vision, benchmarks and path for continued growth.

- Just like in sports- a great team is almost always led by a great coach. In order to get to the top it often takes vision, creativity, experience and innate ability. This is a factor that can’t be ignored in investing.

Company Leadership Should be in The Investment Thesis

Even though having an understanding of how to conduct Equity Valuation is vital, it is also just as important to understand who exactly sits in positions of upper management at the company.

Do not misunderstand us, analyzing a company’s financials and understanding their products or services within their sector should not be ignored; but neither should the very crew who are stirring the ship at sea.

This analogy is important because one of the core principles of free-markets is competition within a set of rules, and you always want to make sure the coach of the team instills the right vision and ethics into the company itself.

GenVest QuickTake

In all honesty, it is no coincidence that some of the most successful companies are headed by well-rounded, wise, knowledgeable leaders. Likewise, these very figures show by habit a superior ability to bring the best out of their employees and execute their business strategy in order to provide first class products and services for consumers and other businesses.

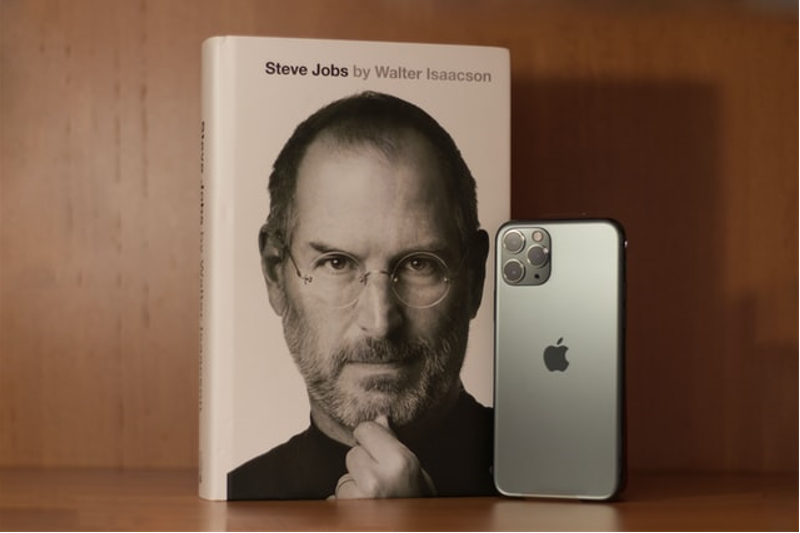

Think of CEO’s such as Satya Nadella of Microsoft, Sundar Pichai of Google, or even Jamie Dimon of J.P. Morgan Chase.

The truth is active investors such as yourself can usually correlate a company’s performance over the long-run to a proven leader who is one of the best in their industry.

What is even better at times is an original founder still actively running the company like Elon Musk with Tesla who is focused on a vision. At one point this was the case with Bill Gates and Microsoft during the 90’s.

Not all equity reports giving their take on a company will say this verbatim but after analyzing a company has strong financials, it can truly come down to, “Yes, it is Tim Cook running Apple and that is why I want to own stock in Apple for the next several years.”

When asked once why an investor should put cash into J.P Morgan Chase right after the financial crisis, an analyst once said, “I have two words, Jamie Dimon.”

While this may upset some possible sports’ fans out there, it is always nice to know you have Bill Belichick at the helm in a competitive league and for companies competing against each other this holds true as well.