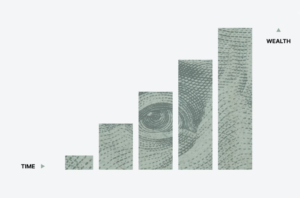

The Mighty S&P 500

The S&P 500, or just S&P measures the stock performance for 500 of the largest publicly traded US companies across various sectors. It is widely recognized as the standard benchmark and gives a strong indication on the health of the U.S. stock market.