Some Investment Funds To Check Out

Interested in creating a Diversified Portfolio across various sectors of the economy? The below list should give you some ideas of where to start when it comes to deciding which funds to invest in.

Interested in creating a Diversified Portfolio across various sectors of the economy? The below list should give you some ideas of where to start when it comes to deciding which funds to invest in.

Why not try and increase your personal wealth by investing in the economy through The Mighty S&P 500 or into a few sectors at times along with the S&P 500 in your portfolio.

Investors and analysts are always trying to determine whether or not a company will grow their earnings moving forward. While it is encouraging to see a company has historically grown their earnings or increased their dividend, you as an investor want to make sure a company is showing sustainable growth.

This might seem a bit ironic for us to state considering one of the main themes at Genvest when it comes to investing is equity growth but once upon a time bonds were actually cool.

Intrinsic Value vs Market Value is really what it all comes down to for those who actively pick stocks.The process of equity valuation is not written in stone but active investors are always trying to select those stocks currently trading at a discount and will most likely outperform an index like the S&P 500 over the long run.

Ensuring you feel confident about the stocks you have selected for your portfolio can feel even more daunting than putting your money into the market in the first place. As mentioned before, you can never truly go wrong with trusting the Mighty S&P 500 and just Let That Puppy Run until you retire.

Understanding the future outlook of a business is perhaps one of the most critical due diligences an investor must perform when selecting common stock for a company or even looking to invest into a particular ETF capturing a sector/industry of the economy.

Whether you are a fan of the Showtime series “Billions” or not, you have probably heard of the almighty “hedge fund”. Trying to gain exposure to a hedge fund should be very strategic and you might find that hedge funds really do not always deserve the praise granted to them.

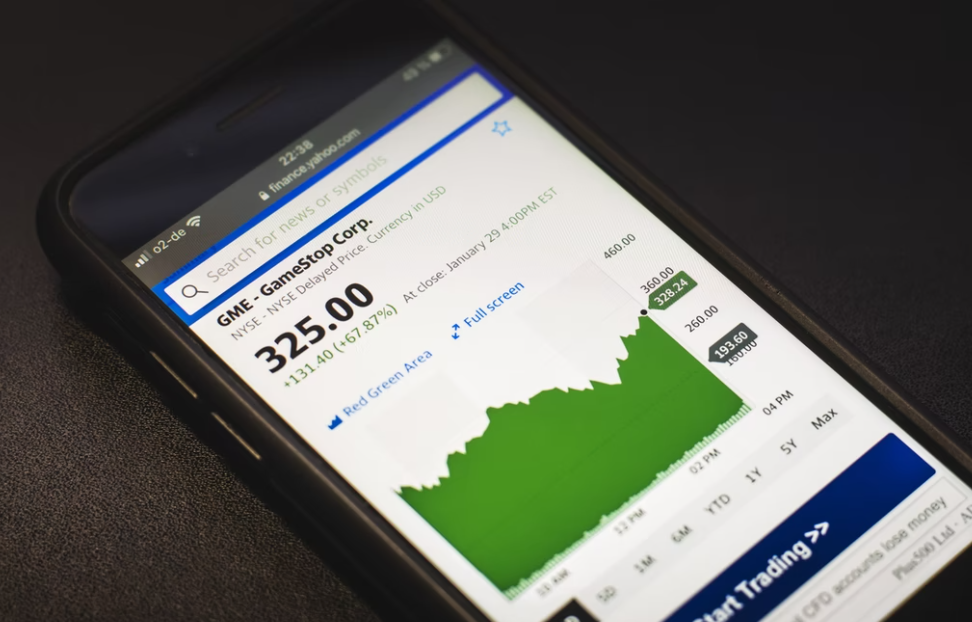

The COVID-19 pandemic introduced something that the market had not seen in some time: Volatility. The pandemic has also given rise to a new generation of day traders who have effectively partnered up with momentum hedge funds, market makers and high frequency traders to move stocks up and down in a violent fashion on a daily basis.

The Dividend Discount Model (DDM) has several variations but at its core looks to provide investors with the intrinsic value of a company to compare against the market value.

Diversification is a word that is talked about frequently in investment circles and among those just getting started. This a word that shouldn’t scare anyone but can take on many different meanings and levels when constructing your portfolio.

Banking Chaos, Why Quality is the Best Policy for Banking Stocks and Why JP Morgan is in a League of Its Own.

Key Points Why Did SCHW’s Stock Price Decline? How are they different from SVB? The collapse of SVB brought to