Using Relative Valuation To Compare Stocks | P/E Ratio

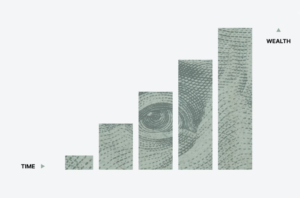

Relative Valuation is a process by which investors compare a company’s value to those in their specific industry and represents the concept of an apples to apples comparison. For investors, there can be a Focus on Trying to Be in the Right Sector when it comes to their investment strategy.