Key Points

- Dividends can be a hot topic in investing circles and often vary by what type of company you are looking at.

- Some investors like to value a business based on dividends but it is important to note that sometimes retaining earnings to invest in company growth is a better strategy.

- It is key to look at how big of a dividend a company COULD pay out vs. what they do pay out.

- At the end of the day a stock is worth what they can afford to give back to investors over time.

Simple but Insightful | Dividend Discount Model (DDM)

There are various models analysts use when conducting the Equity Valuation of a publicly traded company (common stock) and perhaps the most popular amongst these is the Dividend Discount Model (DDM).

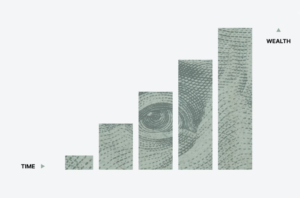

Investors try to predict future cash flows for a company by looking at historical dividend payments and if they will grow their dividend moving forward. It represents the sum of all future dividend payments and is discounted back to the present value.

This will help give an investor an idea of what the intrinsic value might be for a company.

Payout Too Much and Sacrifice Dividend Growth

It is important to remember that past dividends paid do not guarantee future payments. Likewise, investors place focus on sustainable growth through retained income (not paid out) to help the company finance projects in order to increase future earnings.

Companies want to keep you as a loyal shareholder by increasing their dividend growth rate, but in order to do this they cannot pay the full portion of earnings out in the form of dividends. This is to ensure the company can grow sustainably without having to issue more debt.

If the dividend payout ratio is too high, usually ~75% of earnings, this could sacrifice growth but there are several companies that while paying an impressive dividend, they will also readjust their product and service portfolio with the goal of grabbing more market share.

This is why it is important to look at the dividend payout ratio because growth can be correlated to R&D. In a way, it is kind of like all the dots connecting together on what makes a well-run profitable company.

GenVest QuickTake

Investing is a long-term game and you as an investor will want your dividend to grow over time and you will want to be invested in a company that should be able to keep growing their dividend. Proven equity valuation methods are always correlated with companies who have a strong history of growing their cash flow.

One of the great aspects of valuing a company by their dividend is that dividend payments cannot be miscalculated solely on the basis of the fact that they are simply paid or not paid to shareholders.

Analyzing a company’s earnings certainly is important but at times due to various accounting methods are subject to being misrepresented on the income statement.